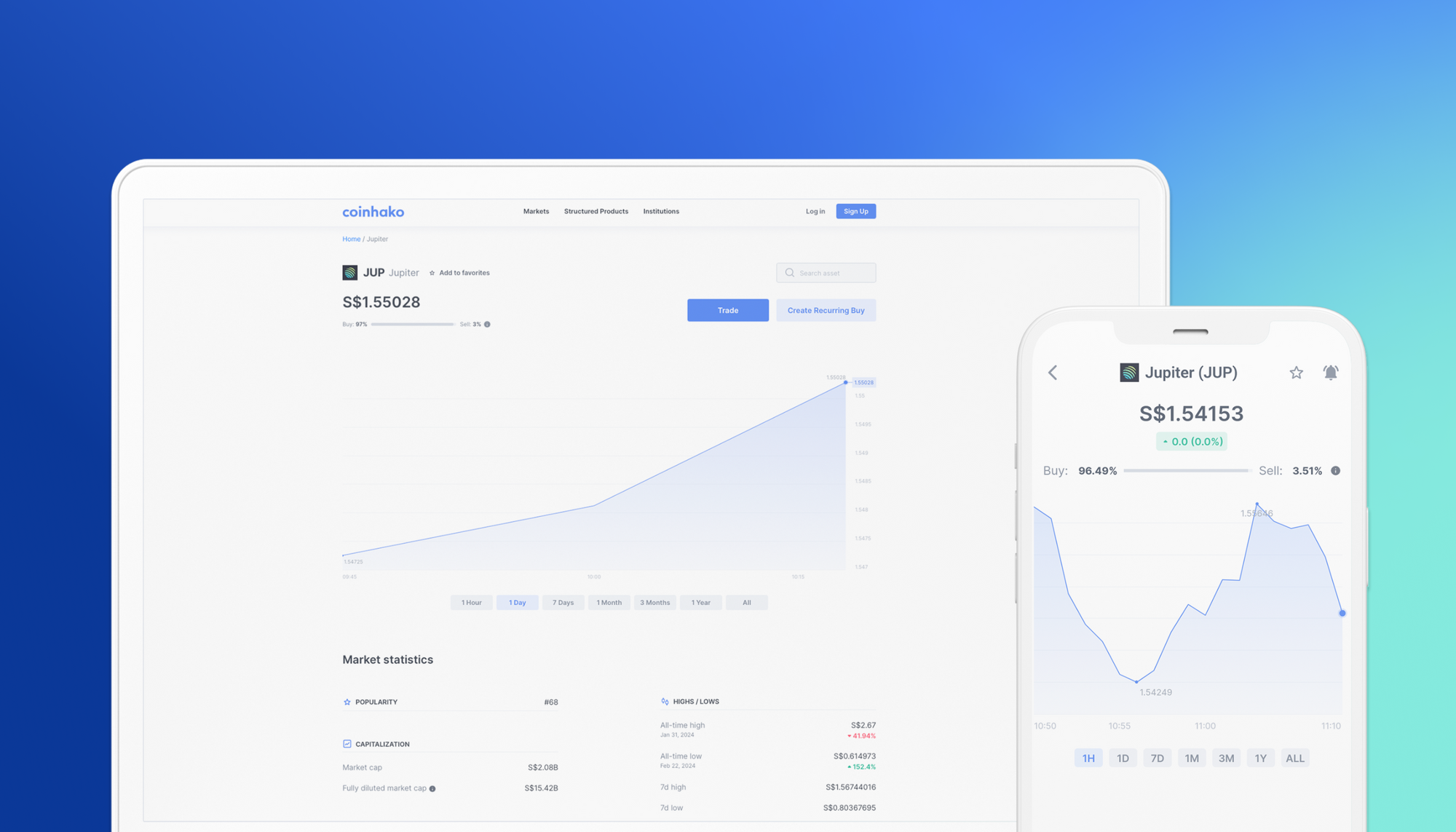

We are thrilled to share that Jupiter (JUP) is now listed on Coinhako.

What is JUP?

JUP serves as a governance token that allows holders to vote on critical aspects of the Jupiter platform, including liquidity provision, future token emissions, and ecosystem initiatives. With the max supply of 10 billion tokens and a large percentage of it reserved for airdrops, JUP is pivotal in the platform’s governance and future development.

As one of the most popular platforms in the DeFi sector on the Solana blockchain, JUP has established itself as a significant liquidity aggregator, a role that involves pooling resources to ensure more efficient and effective token swaps, perpetual futures, and the management of decentralised stablecoins.

Originally, Jupiter’s focus was on aggregating liquidity for token swaps, positioning itself similarly to platforms which fulfil a similar role on Ethereum. However, it has recently expanded its offerings to include GMX-style perpetual futures. Furthermore, Jupiter is looking to launch its own decentralised stablecoin, which seeks to address the custodial and regulatory risks associated with more centralised stablecoins like USDC and USDT.

🚀 View JUP prices on Coinhako now

How does Jupiter work?

Jupiter, the world’s leading DEX aggregator on the Solana blockchain, represents a significant advancement in the DeFi space — it is a dynamic and integrated network comprising different functions and a strong link to the Solana’s features and user base.

The main function of the Jupiter Ecosystem is as a DEX aggregator on the Solana blockchain. This allows Jupiter to pool liquidity from multiple decentralised exchanges, providing users the best possible trading prices and deep liquidity pools. Jupiter’s ties to the Solana features, such as low transaction fees and high throughput, have also been pivotal in its growth, making it a preferred platform for traders and liquidity providers.

Jupiter’s bridge comparator tool allows for efficient cross-chain trades by enabling users to select the most suitable bridge for transferring tokens from other blockchains to Solana. This feature is particularly valuable for users seeking to optimise their trading strategies and minimise transaction costs.

Why does JUP stand out?

Jupiter has grown exponentially in popularity and trading volume, thanks to the emerging memecoin and airdrop market on Solana. Its focus on the Solana ecosystem along with a single-chain approach has helped their position in the DeFi sector.

Another feature that makes Jupiter an innovator in the space is the bridge comparator tool — it allows users to compare and select the most efficient bridge for transferring tokens between different blockchains and Solana, solidifying them as one of the major players in the cross interoperability space.

All these, alongside its user-friendly interface and reliable trading mechanism has made Jupiter the premier platform for users on the Solana blockchain.

What can you do with JUP on Coinhako?

JUP will be available for users to trade across all swap pairs on Coinhako.

To gain access to any of these trading pairs, you can either:

- Fund your SGD wallet on Coinhako instantly with PayNow (or any other supported payment methods)

- Purchase JUP instantly with Visa / Mastercard

Please note that the sending and receiving of JUP will not be available for this release.

Risk Warning on Digital Payment Token Services

Hako Technology Pte Ltd ("Coinhako") is licensed to provide digital payment token services under the Payment Services Act 2019 (No. 2 of 2019).

The Monetary Authority of Singapore ("MAS") requires us to provide this risk warning to you as a customer of a digital payment token ("DPT") service provider.

Before you pay your DPT service provider any money or DPT, you should be aware of the following.

- Your DPT service provider is licensed by MAS to provide DPT services. Please note that this does not mean you will be able to recover all the money or DPTs you paid to your DPT service provider if your DPT service provider’s business fails.

- You should not transact in the DPT if you are not familiar with this DPT. This includes how the DPT is created, and how the DPT you intend to transact is transferred or held by your DPT service provider.

- You should be aware that the value of DPTs may fluctuate greatly. You should buy DPTs only if you are prepared to accept the risk of losing all of the money you put into such tokens.

- You should be aware that your DPT service provider, as part of its licence to provide DPT services, may offer services related to DPTs which are promoted as having a stable value, commonly known as “stablecoin”.

Visit: Coinhako.com/risk-disclosure for more information.